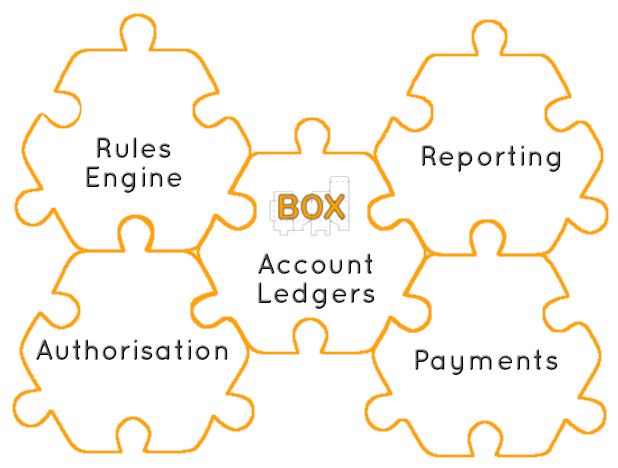

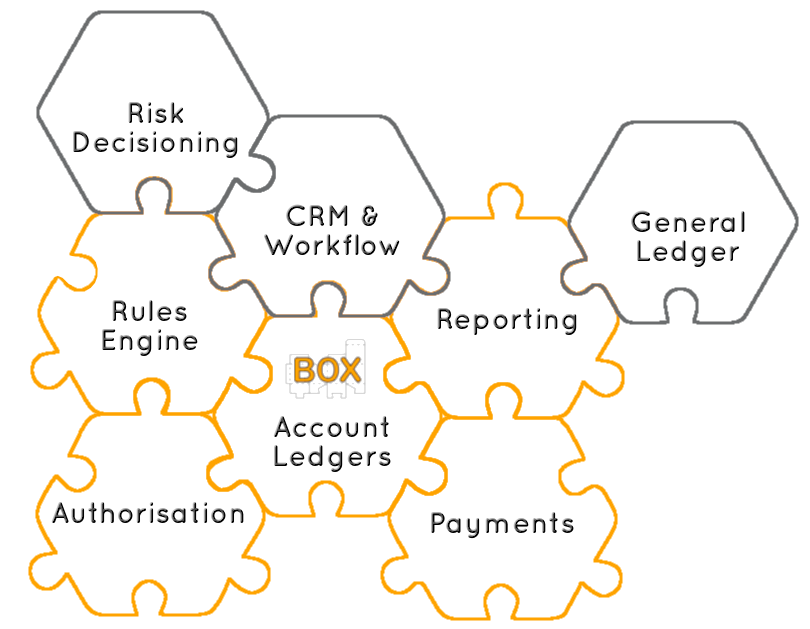

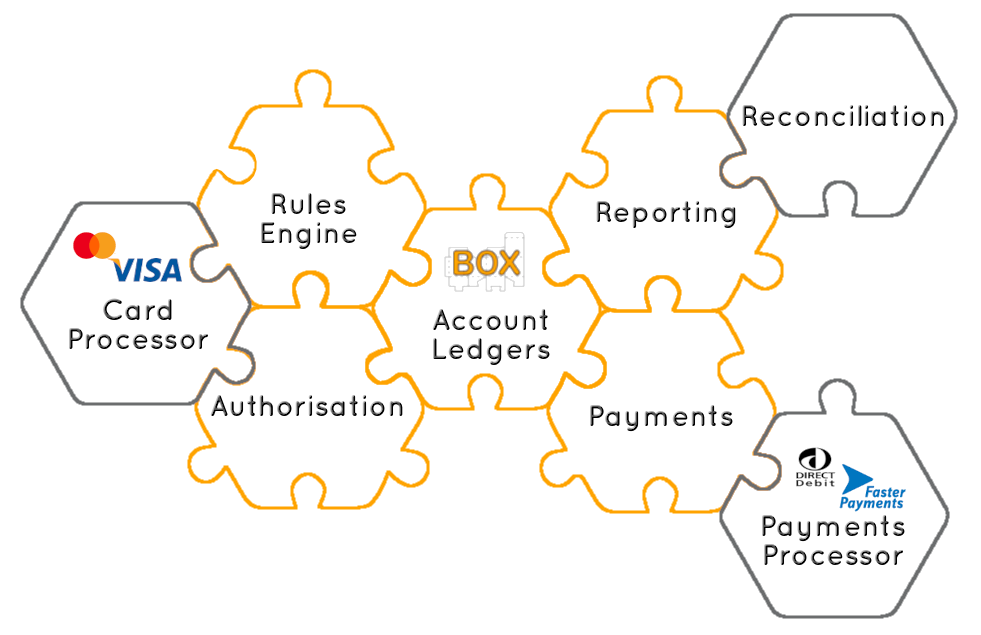

Flexible SaaS credit platform

- manages credit limits and account balances

- authorises spend in real time

- disburses loans and collects savings

- calculates accrued interest and fees

- provides statement data

- triggers repayments & updates funds received

- reports and updates general ledgers